oklahoma state auto sales tax

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. Typically the tax is determined by the.

Oklahoma Tribal License Plates Choctaw Vehicle Tags Choctaw Nation Of Oklahoma

325 of ½ the actual purchase pricecurrent value.

. Motor vehicle taxes in. Counties and cities can charge an additional local sales tax of up to 65 for a. Bartlesville OK Sales Tax Rate.

When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car. 405-607-8909 emailomvcokgov Office Hours. 609 rows Oklahoma Sales Tax.

Altus OK Sales Tax Rate. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Ada OK Sales Tax Rate.

325 of 65 of ½ the actual purchase pricecurrent value. Ad Register and Subscribe Now to work on your OK Resale Certificate more fillable forms. Average Local State Sales Tax.

Our free online Oklahoma sales tax calculator calculates exact sales tax by state county city or ZIP code. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. Average Sales Tax With Local.

There are special tax rates and conditions for used vehicles which we will cover later. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average. Oklahoma City OK 73116 Phone.

The Legislature removed the. Oklahoma charges 45 percent state sales tax on sales of tangible personal property and certain services. Total Sales Tax Rate.

The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Darcy Jech R-Kingfisher would. Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from.

Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax. The normal sales tax in Oklahoma is 45. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933.

125 sales tax and 325 excise tax for a total 45 tax rate. OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers. The Oklahoma OK state sales tax rate is currently 45.

Ardmore OK Sales Tax Rate. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Used vehicles are taxed a flat fee of 20 on the.

As of July 1 2017 Oklahoma. 800 am to 430 pm. The state also has some special taxes and levies.

Senate Bill 1619 authored by Sen. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

When a vehicle is purchased under current law a sales tax of 125. PdfFiller allows users to Edit Sign Fill Share all type of documents online. 125 sales tax and 325 excise tax for a total 45 tax rate.

We would like to show you a description here but the site wont allow us. Oklahoma Sales Tax Guide. Oklahoma charges two taxes for the purchase of new motor vehicles.

Maximum Possible Sales Tax.

Vehicle Title Tax Insurance Registration Costs By State For 2021

State And Local Tax Distribution Oklahoma Policy Institute

Florida Sales Tax For Nonresident Car Purchases 2020

Bills Of Sale In Oklahoma The Templates Facts You Need

Oklahoma Tax Commission Facebook

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Used Cars In Oklahoma For Sale Enterprise Car Sales

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

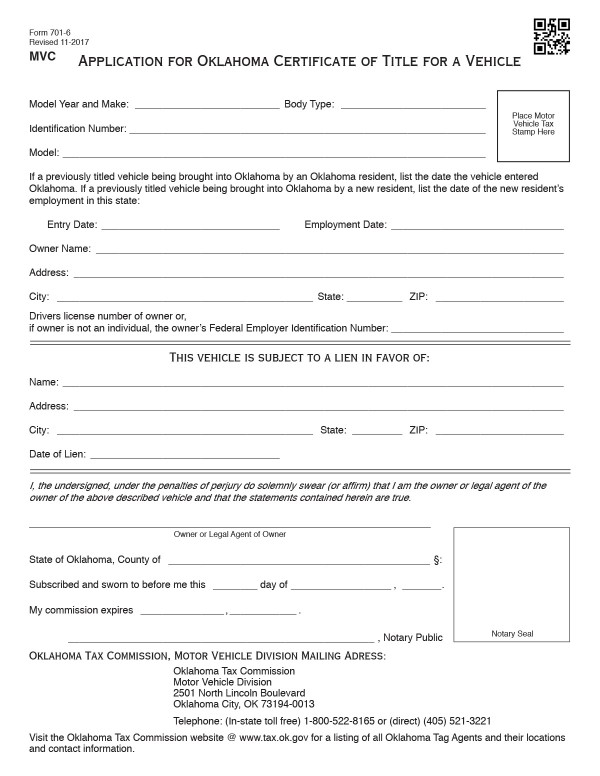

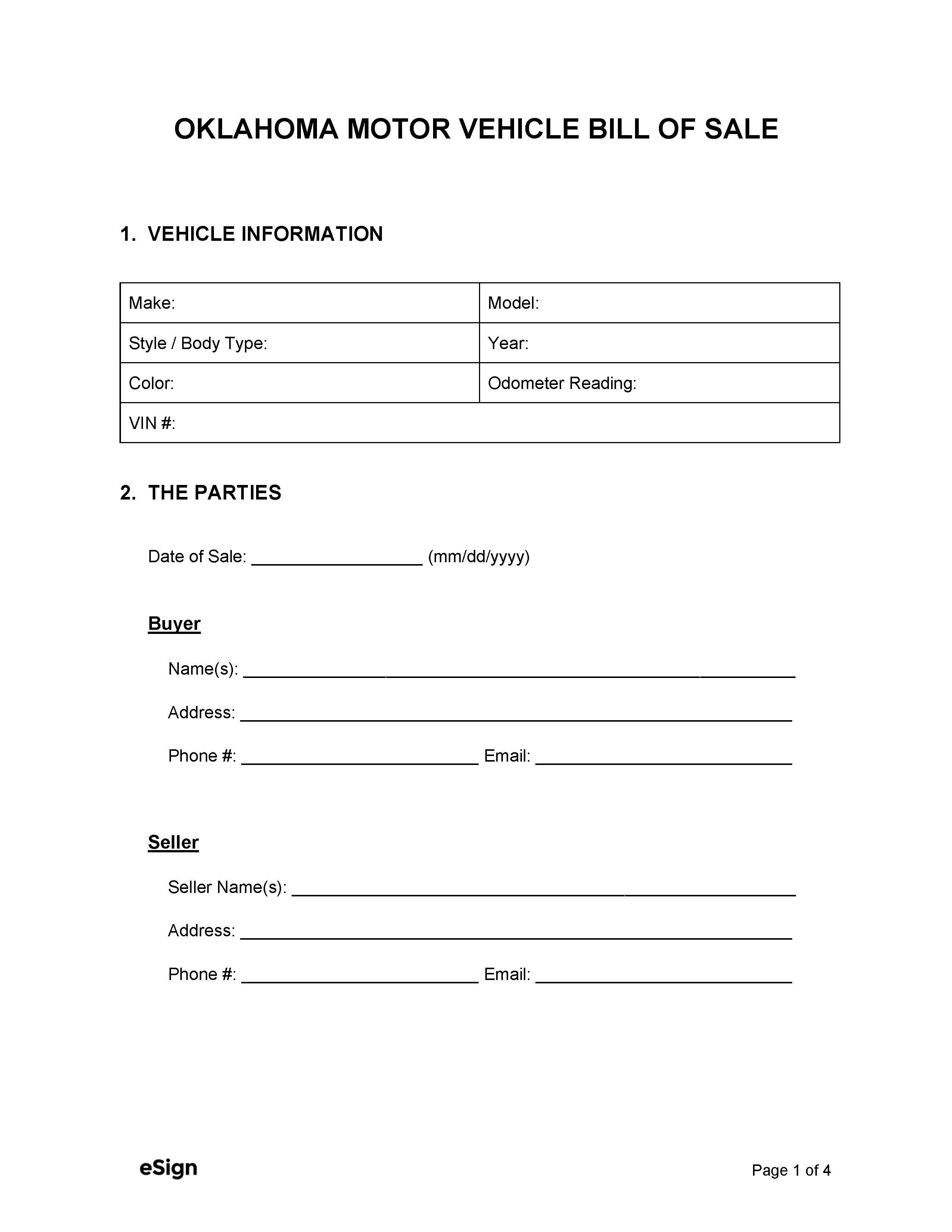

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

What S The Car Sales Tax In Each State Find The Best Car Price

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

The States With The Lowest Car Tax The Motley Fool

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Fy 2023 Budget Highlights Oklahoma Policy Institute

Sales Taxes In The United States Wikipedia

What S The Car Sales Tax In Each State Find The Best Car Price